Tax Conversion To Percentage Chart - In the busy digital age, where information takes a trip at the speed of light, performance is vital. Experts, trainees, and lovers alike frequently find themselves requiring to transform systems for numerous purposes, from project preparing to scholastic ventures. Enter the online conversion chart-- a versatile tool that streamlines intricate system conversions, making tasks quicker and more precise.

Tax Conversion To Percentage Chart

Tax Conversion To Percentage Chart

The Emergence of Digital Conversion Aids In today's globalized world, where numerous measurement systems exist together, online conversion charts have actually ended up being an important tool. These charts provide a convenient and accessible way to convert systems, no matter where you are, as long as you have a web connection. Whether you're dealing with a task with global partners, managing a company with global customers, or preparing a meal utilizing a recipe from another country, these charts simplify the conversion process, saving you effort and time.

Tax Conversion To Percentage Chart

A Versatile Resource Online conversion charts stand out for their capability to effortlessly handle different units, whether it's length, weight, volume, temperature, currency, or anything else. The varied applications of these tools make them ideal for multiple industries and fields of study, owing to their versatility.

Seamless Navigation with Intuitive Interface

An exceptional online conversion chart is distinguished by its easy to use interface, enabling effortless navigation through different units. The conversion procedure must be instinctive, allowing users to promptly and precisely convert values without requiring to hang around learning how to utilize the tool. The most effective tools boast a versatile design that allows users to perfectly change between metric and imperial units, personalize conversions, and gain access to up-to-date updates.

The capability to gain access to online conversion charts at any time and location is a major benefit. With an internet connection, specialists can utilize these tools on various devices, such as computers, tablets, or mobile phones. This availability is particularly beneficial for those who need quick conversions while on the move.

Precision in the Digital Age: In today's quickly changing digital landscape, it's essential to have access to up-to-date details when it pertains to currency exchange rates, product costs, and other vibrant values. That's why real-time updates are an essential for online conversion charts. Whether you're a service operating in the international marketplace or a specific investor keeping track of moving market patterns, this function makes sure that your conversions are constantly based on the latest, most precise information.

Modification Based on Your Needs Every user has distinct requirements and choices when it pertains to system conversions. The best online conversion charts recognize this and allow for modification. Whether you want to focus on certain units, set defaults, or save favorite conversions, an adjustable tool adapts to your particular requirements.

Currency Conversion within your reaches In an interconnected international economy, currency conversion is a frequent need. Online conversion charts that include current currency exchange rates empower users to make informed monetary decisions, whether they are carrying out worldwide service or preparing a journey abroad.

Mobile-Friendly for On-the-Go Conversions The modern-day expert is constantly on the move, and mobile-friendly conversion charts accommodate this way of life. With responsive designs and optimized layouts, these tools guarantee that users can make conversions conveniently, whether they're in a boardroom, class, or cooking area.

Enhancing Educational Endeavors For students and educators, online conversion charts serve as invaluable educational tools. They not just streamline intricate mathematical ideas however also provide real-world applications for system conversions. Interactive tutorials, visual representations, and useful examples make learning appealing and applicable.

Integration with Popular Applications The best online conversion charts do not exist in isolation. They flawlessly integrate with popular applications, boosting their functionality. Whether it's integration with spreadsheet software, browsers, or even virtual assistants, these tools end up being an integral part of your digital toolkit.

Privacy-Focused and Secure Just like any online tool, privacy and security are paramount. Reliable online conversion charts prioritize user information security, using robust security measures to safeguard sensitive details. Users can with confidence rely on these tools without jeopardizing their personal privacy.

Consistent Evolution to Meet User Needs The digital landscape is ever-evolving, and the best online conversion charts evolve with it. Regular updates, function improvements, and responsiveness to user feedback make sure that these tools stay appropriate and continue to satisfy the evolving requirements of their user base.

Conclusion In conclusion, online conversion charts have actually become essential tools for people and experts seeking efficiency in their daily tasks. From the simplicity of an easy to use user interface to the intricacy of real-time currency conversions, these charts cater to a varied range of requirements. Whether you're an experienced professional, a trainee browsing the complexities of academia, or someone pursuing individual projects, incorporating online conversion charts into your toolkit is an action towards mastering effectiveness in the digital age. Make every conversion seamless, accurate, and uncomplicated-- explore the world of online conversion charts today.

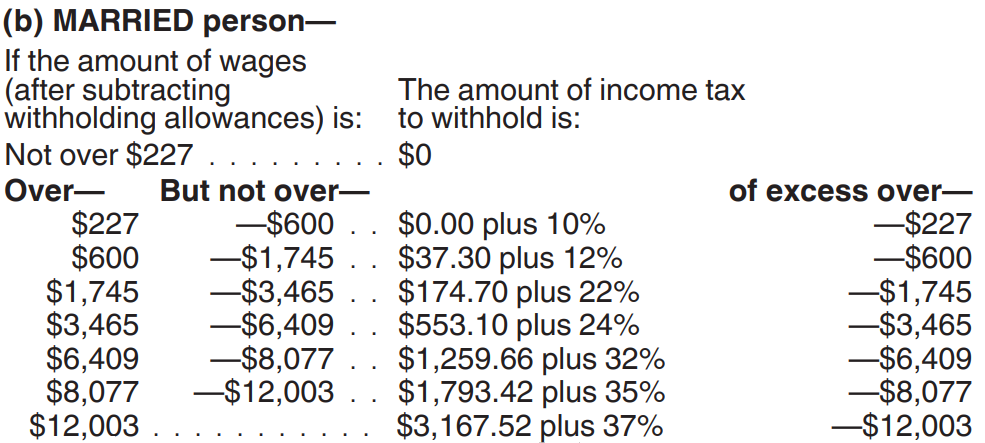

You ll owe income taxes of 10 to 37 depending on your income tax rate on all the money you convert from a traditional IRA or rollover from a 401 k to a Roth IRA Solution First convert tax percentage to a decimal tax rate 7 25 100 0 0725 Then use the formula to calculate the total total price price x tax rate 1 500 00 1 500 00 x 0 0725 1 500 00 108 75 1 608 75 Where the tax amount is 108 75 Or use the alternate formula total price 1 tax rate 1 500 00 1 0 0725 Taxable income is always lower than gross income since the U S allows taxpayers to deduct certain income from their gross income to determine taxable income To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI

Federal Income Tax Calculator 2022 2023 SmartAsset

How To Calculate Payroll And Income Tax Deductions PEO Human Resources Blog

How Do Federal Income tax Rates Work Tax Policy Center

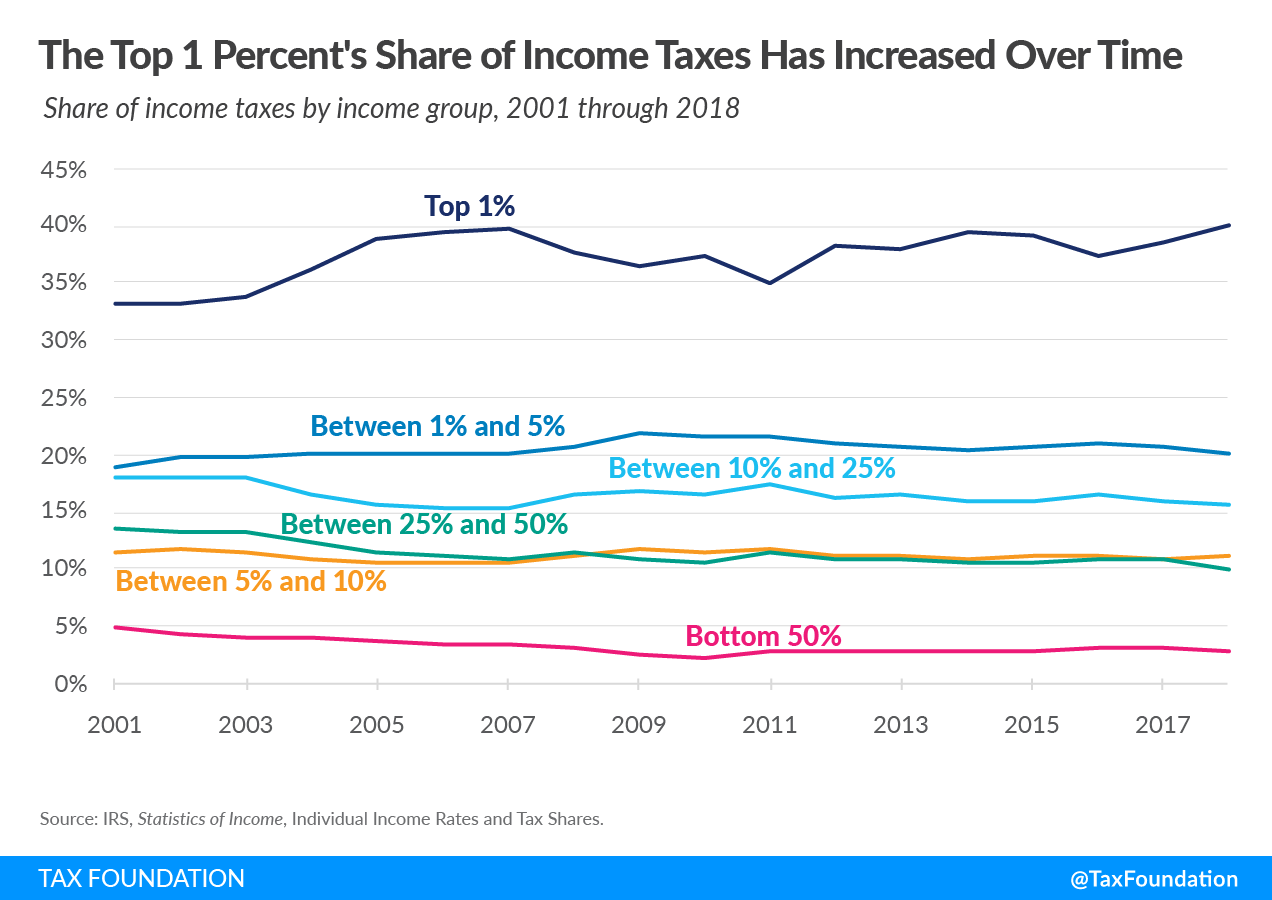

Summary Of The Latest Federal Income Tax Data Tax Foundation

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

The Top 1 Percent s Tax Rates Over Time Tax Foundation

State Individual Income Tax Rates And Brackets Tax Foundation

Tax As A Percentage Of Total Amount IGCSE At Mathematics Realm

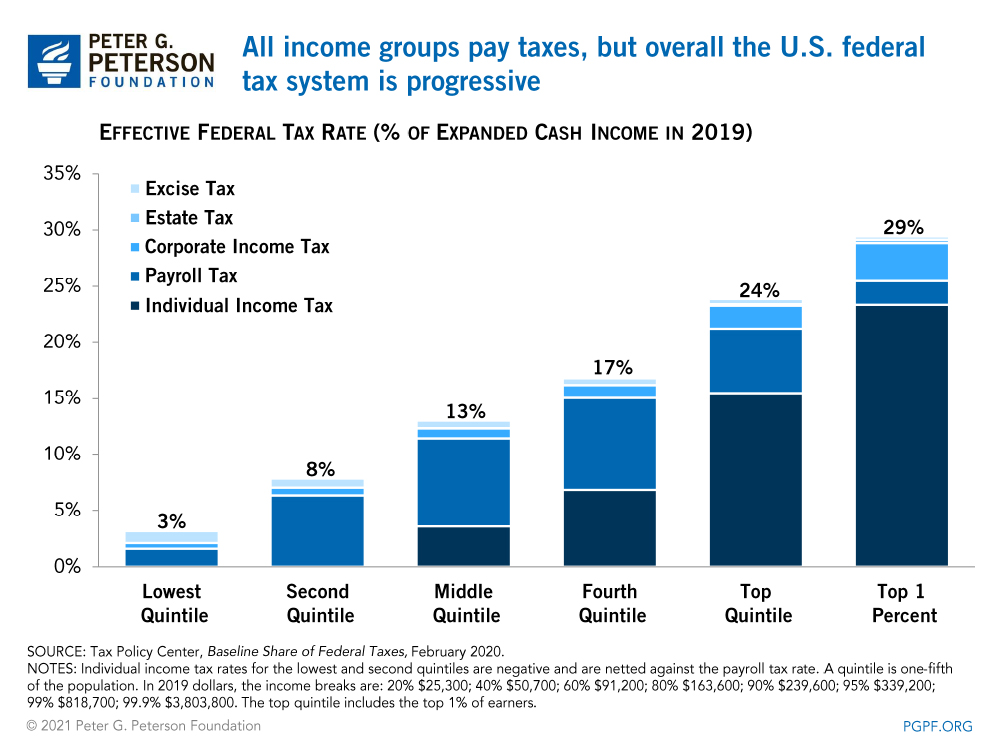

Budget Basics Who Pays Taxes

11 charts That Explain taxes In America Vox

Income tax What s It All About